where's my unemployment tax refund irs

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Viewing the details of your IRS account.

Irs Sends First Unemployment Tax Refunds But Automatic State Refunds Are In Limbo Mlive Com

The IRS has sent 87 million unemployment compensation refunds so far.

. You wont be able to track the progress of your refund through the. The IRS previously issued refunds related to unemployment compensation exclusion in May and June and it will continue to issue refunds throughout the summer. Is available almost all of the time.

Our Refund Trace feature is not. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. These updated FAQs were released to the public in Fact Sheet 2022-21 PDF March 23 2022. This is the fourth round of refunds related to the unemployment compensation.

Unemployment Refund Tracker Unemployment Insurance TaxUni. A call to the IRS should be made if an individual has waited more than twenty-one days after filing electronically or if the status on the Wheres My Refund tells you to contact. The legislation excludes only 2020 unemployment benefits from taxes.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. However our system is not available every Monday early from 12 am. Will I receive a 10200 refund.

Check The Refund Status Through Your Online Tax Account. Said it would begin processing the simpler returns first or those eligible for. The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of unemployment compensation they received in tax year 2020 only.

Report IRS imposter scams online or by calling TIGTA at 1-800-366-4484. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Midnight to 3 am.

If you received unemployment benefits in 2020 a tax refund may be on its way to you. Because the change occurred after some people filed their taxes the IRS will take steps in the spring. The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable.

Using the IRSs Wheres My Refund feature. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. COVID Tax Tip 2021-87 June 17 2021.

Forward email messages that claim to be from the IRS to email protectedirsgov. The unemployment tax refund is only for those filing individually. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records.

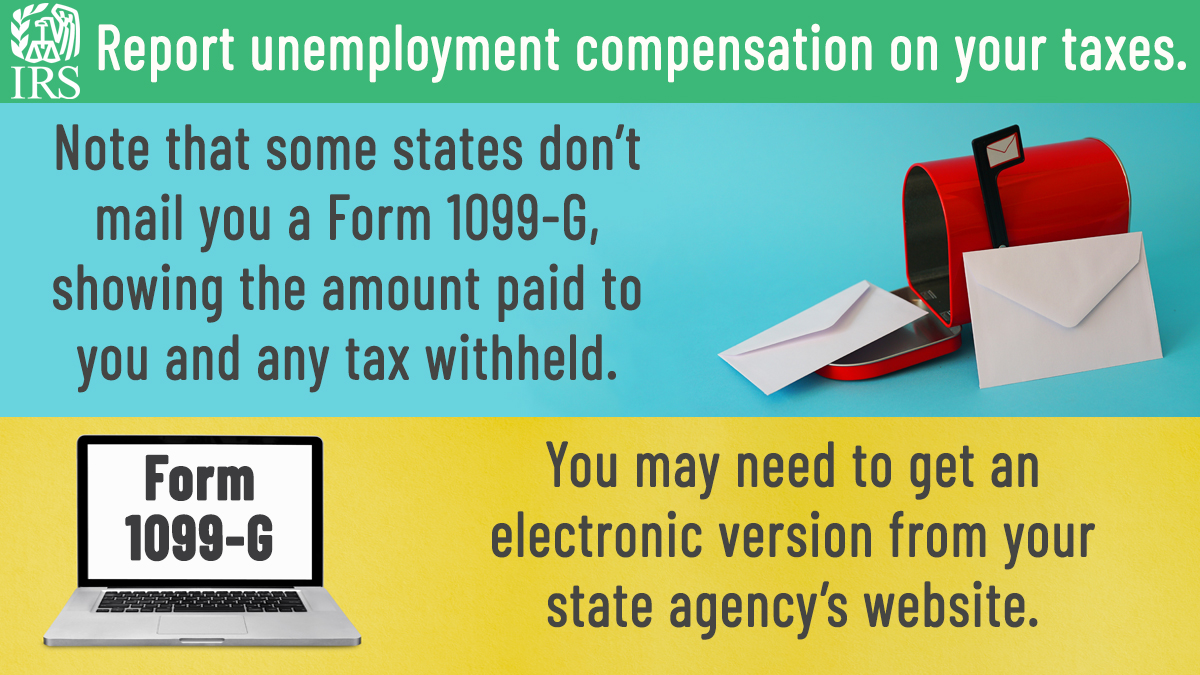

The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. Income Tax Refund Information.

To request tax return or. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160. Updated March 23 2022 A1.

The first refunds are expected to be issued in May and will continue into the summer. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see.

Where S My Refund Tax Refund Tracking Guide From Turbotax

Unemployed In 2020 Get Ready For A Big Tax Refund

2020 Unemployment Tax Break H R Block

Will My Irs Tax Transcript Help Me Find Out When I Ll Get My Refund And What Does It Mean When Transcript Says N A Aving To Invest

Many Tax Refunds Are Delayed This Year Here S Why According To The Irs Silive Com

Unemployment Tax Adjustments By Irs In The Works With First Refunds To Go Out In May Don T Mess With Taxes

Irs Unemployment Tax Refund Timeline For September Checks

Irs Is Sending Unemployment Tax Refund Checks This Week Money

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Oregon Irs Will Automatically Adjust Returns For Those Who Paid Taxes On Unemployment Benefits Oregonlive Com

Filing Your Taxes If You Claimed Unemployment Benefits What To Know Where To Find Help Kqed

Tax Return Status Why Is My Federal Refund Delayed Abc10 Com

Irs Letter 707c Refund Or Return Delayed In Processing Refund Forthcoming H R Block

H R Block Good News Up To 10 200 Of Your Unemployment Income Could Be Tax Free The Irs Will Automatically Adjust Your Taxes And Any Refunds Will Start Going Out In May

Irs Sending Unemployment Tax Refund How To Contact Irs If Missing As Usa